Petroleum

2007 Schools Wikipedia Selection. Related subjects: Business; Geology and geophysics

Petroleum (from Latin petra – rock and oleum – oil) or crude oil (also known as black gold) is a black, dark brown or greenish liquid found in formations in the earth. The American Petroleum Institute, in its Manual of Petroleum Measurement Standards (MPMS), defines it as "a substance, generally liquid, occurring naturally in the earth and composed mainly of mixtures of chemical compounds of carbon and hydrogen with or without other nonmetallic elements such as sulfur, oxygen, and nitrogen."

Petroleum is found in porous rock formations in the upper strata of some areas of the Earth's crust. It consists of a complex mixture of hydrocarbons, mostly alkanes, but may vary greatly in appearance and composition. Petroleum is used mostly, by volume, for producing fuel oil and petrol ( gasoline), both important " primary energy" sources ( IEA Key World Energy Statistics). Petroleum is also the raw material for many chemical products, including solvents, fertilizers, pesticides, and plastics. 84% (37 of 42 gallons in a typical barrel) of all petroleum extracted is processed as fuels, including gasoline, diesel, jet, heating, and other fuel oils, and liquefied petroleum gas ; the other 16% is converted into other materials such as plastic.

Known reserves of petroleum are typically estimated at around 1.2×1012 barrels with at least one estimate as high as 3.74×1012 barrels (3,740,000,000,000). Consumption is currently around 84×106 barrels per day, or 31×109 barrels per year. Usable oil reserves are only about 1/3 of total reserves. At current consumption levels, world oil supply would be gone in about 33 years. However, this ignores any additions to known reserves, changes in demand, etc. As the supply of petroleum becomes more scarce, consumers may look to alternative fuel sources such as ethanol, photovoltaic, or clean-burning hydrogen. Petroleum forms naturally within the earth too slowly to be sustainable for human use.

Formation

Chemistry

The chemical structure of petroleum is composed of hydrocarbon chains of different lengths. These different hydrocarbon chemicals are separated by distillation at an oil refinery to produce gasoline, jet fuel, kerosene, and other hydrocarbons. The general formula for these hydrocarbons is CnH2n+2. For example 2,2,4-Trimethylpentane, widely used in gasoline, has a chemical formula of C8H18 which reacts with oxygen exothermically:

C8H18(aq) + 12.5O2(g) → 8CO2(g) + 9H2O(g) + heat

Incomplete combustion of petroleum or gasoline results in emission of poisionous gases such as carbon monoxide and/or nitric oxide. For example:

C8H18(aq) + 12.5O2(g) + N2(g) → 6CO2(g) + 2CO(g) + 2NO(g) + 9H2O(g) + heat

Formation of petroleum occurs in a variety of mostly endothermic reactions in high temperature and/or pressure. For example, a kerogen may break down into hydrocarbons of different lengths:

CH1.45(s) + heat → .663CH1.6(aq) + .076CH2(aq) + .04CH2.6(g) + .006CH4(g) + .012CH2.6(s) + .018CH4.0(s) + .185CH.25(s)

Biogenic theory

Most geologists view crude oil and natural gas, as the product of compression and heating of ancient organic materials over geological time. According to this theory, oil is formed from the preserved remains of prehistoric zooplankton and algae which have been settled to the sea bottom in large quantities under anoxic conditions. ( Terrestrial plants tend to form coal) Over geological time this organic matter, mixed with mud, is buried under heavy layers of sediment. The resulting high levels of heat and pressure cause the remains to metamorphose, first into a waxy material known as kerogen which is found in various oil shales around the world, and then with more heat into liquid and gaseous hydrocarbons in a process known as catagenesis. Because most hydrocarbons are lighter than rock or water, these sometimes migrate upward through adjacent rock layers until they become trapped beneath impermeable rocks, within porous rocks called reservoirs. Concentration of hydrocarbons in a trap forms an oil field, from which the liquid can be extracted by drilling and pumping.

Geologists often refer to an "oil window" which is the temperature range that oil forms in—below the minimum temperature oil remains trapped in the form of kerogen, and above the maximum temperature the oil is converted to natural gas through the process of thermal cracking. Though this happens at different depths in different locations around the world, a 'typical' depth for the oil window might be 4–6 km. Note that even if oil is formed at extreme depths, it may be trapped at much shallower depths, even if it is not formed there. (In the case of the Athabasca Oil Sands, it is found right at the surface.) Three conditions must be present for oil reservoirs to form: first, a source rock rich in organic material buried deep enough for subterranean heat to cook it into oil; second, a porous and permeable reservoir rock for it to accumulate in; and last a cap rock (seal) that prevents it from escaping to the surface.

If an oil well were to run dry and be capped, it would likely fill back to its original supply eventually. There is considerable question about how long this would take. Some formations appear to have a regeneration time of decades. Majority opinion is that oil is being formed at less than 1% of the current consumption rate.

The vast majority of oil that has been produced by the earth has long ago escaped to the surface and been biodegraded by oil-eating bacteria. What oil companies are looking for is the small fraction that has been trapped by this rare combination of circumstances. Oil sands are reservoirs of partially biodegraded oil still in the process of escaping, but contain so much migrating oil that, although most of it has escaped, vast amounts are still present - more than can be found in conventional oil reservoirs. On the other hand, oil shales are source rocks that have never been buried deep enough to convert their trapped kerogen into oil.

The reactions that produce oil and natural gas are often modeled as first order breakdown reactions, where kerogen is broken down to oil and natural gas by a set of parallel reactions, and oil eventually breaks down to natural gas by another set of reactions. The first set was originally patented in 1694 under British Crown Patent No. 330 covering "a way to extract and make great quantityes of pitch, tarr, and oyle out of a sort of stone." The latter set is regularly used in petrochemical plants and oil refineries.

Abiogenic theory

The idea of abiogenic petroleum origin was championed in the Western world by astronomer Thomas Gold based on thoughts from Russia, mainly on studies of Nikolai Kudryavtsev. The idea proposes that hydrocarbons of purely geological origin exist in the planet. Hydrocarbons are less dense than aqueous pore fluids, and are proposed to migrate upward through deep fracture networks. Thermophilic, rock-dwelling microbial life-forms are proposed to be in part responsible for the biomarkers found in petroleum.

However, this theory is a minority opinion, especially amongst geologists and no oil companies are currently known to explore for oil based on this theory.

Means of production

Extraction

The most common method of obtaining petroleum is extracting it from oil wells found in oil fields. After the well has been located, various methods are used to recover the petroleum. Primary recovery methods are used to extract oil that is brought to the surface by underground pressure, and can generally recover about 20% of the oil present. After the oil pressure has depleated to the point that the oil is no longer brought to the surface, secondary recovery methods draw another 5 to 10% of the oil in the well to the surface. Finally, when secondary oil recovery methods are no longer viable, tertiary recovery methods reduce the viscosity of the oil in order to bring more to the surface.

Alternative methods

As oil prices continue to escalate, other alternatives to producing oil have been gaining importance. The best known such methods involve extracting oil from sources such as oil shale or tar sands. These resources are known to exist in large quantities; however, extracting the oil at low cost without negatively impacting the environment remains a challenge.

It is also possible to transform natural gas or coal into oil (or, more precisely, the various hydrocarbons found in oil). The best-known such method is the Fischer-Tropsch process. It was a concept pioneered in Nazi Germany when imports of petroleum were restricted due to war and Germany found a method to extract oil from coal. It was known as Ersatz ("substitute" in German), and accounted for nearly half the total oil used in WWII by Germany. However, the process was used only as a last resort as naturally occurring oil was much cheaper. As crude oil prices increase, the cost of coal to oil conversion becomes comparatively cheaper. The method involves converting high ash coal into synthetic oil in a multistage process. Ideally, a ton of coal produces nearly 200 liters (1.25 bbl, 52 US gallons) of crude, with by-products ranging from tar to rare chemicals.

Currently, two companies have commercialised their Fischer-Tropsch technology. Shell in Bintulu, Malaysia, uses natural gas as a feedstock, and produces primarily low-sulfur diesel fuels. Sasol in South Africa uses coal as a feedstock, and produces a variety of synthetic petroleum products. The process is today used in South Africa to produce most of the country's diesel fuel from coal by the company Sasol. The process was used in South Africa to meet its energy needs during its isolation under Apartheid. This process has received renewed attention in the quest to produce low sulfur diesel fuel in order to minimize the environmental impact from the use of diesel engines.

An alternative method is the Karrick process, which converts coal into crude oil, pioneered in the 1930s in the United States.

More recently explored is thermal depolymerization (TDP). In theory, TDP can convert any organic waste into petroleum.

History

Petroleum, in some form or other, is not a substance new in the world's history. More than four thousand years ago, according to Herodotus and confirmed by Diodorus Siculus, asphalt was employed in the construction of the walls and towers of Babylon; there were oil pits near Ardericca (near Babylon), and a pitch spring on Zacynthus. Great quantities of it were found on the banks of the river Issus, one of the tributaries of the Euphrates. Ancient Persian tablets indicate the medicinal and lighting uses of petroleum in the upper levels of their society.

The first oil wells were drilled in China in the 4th century or earlier. They had depths of up to 243 meters and were drilled using bits attached to bamboo poles. The oil was burned to evaporate brine and produce salt. By the 10th century, extensive bamboo pipelines connected oil wells with salt springs. The ancient records of China and Japan are said to contain many allusions to the use of natural gas for lighting and heating. Petroleum was known as burning water in Japan in the 7th century.

In the 8th century, the streets of the newly constructed Baghdad were paved with tar, derived from easily accessible petroleum from natural fields in the region. In the 9th century, oil fields were exploited in Baku, Azerbaijan, to produce naphtha. These fields were described by the geographer Masudi in the 10th century, and by Marco Polo in the 13th century, who described the output of those wells as hundreds of shiploads. (See also: Timeline of Islamic science and technology.)

The earliest mention of American petroleum occurs in Sir Walter Raleigh's account of the Trinidad Pitch Lake in 1595; whilst thirty-seven years later, the account of a visit of a Franciscan, Joseph de la Roche d'Allion, to the oil springs of New York was published in Sagard's Histoire du Canada. A Russian traveller, Peter Kalm, in his work on America, published in 1748, showed on a map the oil springs of Pennsylvania.

The modern history of petroleum began in 1846, with the discovery of the process of refining kerosene from coal by Atlantic Canada's Abraham Pineo Gesner. Poland's Ignacy Łukasiewicz discovered a means of refining kerosene from the more readily available "rock oil" ("petr-oleum") in 1852 and the first rock oil mine was built in Bóbrka, near Krosno in southern Poland in the following year. These discoveries rapidly spread around the world, and Meerzoeff built the first Russian refinery in the mature oil fields at Baku in 1861. At that time Baku produced about 90% of the world's oil. The battle of Stalingrad was fought over Baku (now the capital of the Azerbaijan Republic).

The first commercial oil well drilled in North America was in Oil Springs, Ontario, Canada in 1858, dug by James Miller Williams. The American petroleum industry began with Edwin Drake's drilling of a 69-foot-deep oil well in 1859, on Oil Creek near Titusville, Pennsylvania, for the Seneca Oil Company (originally yielding 25 barrels a day, by the end of the year output was at the rate of 15 barrels). The industry grew slowly in the 1800s, driven by the demand for kerosene and oil lamps. It became a major national concern in the early part of the 20th century; the introduction of the internal combustion engine provided a demand that has largely sustained the industry to this day. Early "local" finds like those in Pennsylvania and Ontario were quickly exhausted, leading to "oil booms" in Texas, Oklahoma, and California.

Early production of crude petroleum in the United States:

- 1859: 2,000 barrels

- 1869: 4,215,000 barrels

- 1879: 19,914,146 barrels

- 1889: 35,163,513 barrels

- 1899: 57,084,428 barrels

- 1906: 126,493,936 barrels

By 1910, significant oil fields had been discovered in Canada (specifically, in the province of Alberta), the Dutch East Indies (1885, in Sumatra), Persia (1908, in Masjed Soleiman), Peru, Venezuela, and Mexico, and were being developed at an industrial level.

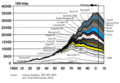

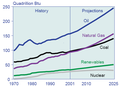

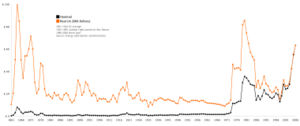

Even until the mid- 1950s, coal was still the world's foremost fuel, but oil quickly took over. Following the 1973 energy crisis and the 1979 energy crisis, there was significant media coverage of oil supply levels. This brought to light the concern that oil is a limited resource that will eventually run out, at least as an economically viable energy source. At the time, the most common and popular predictions were always quite dire, and when they did not come true, many dismissed all such discussion. The future of petroleum as a fuel remains somewhat controversial. USA Today news (2004) reports that there are 40 years of petroleum left in the ground. Some would argue that because the total amount of petroleum is finite, the dire predictions of the 1970s have merely been postponed. Others argue that technology will continue to allow for the production of cheap hydrocarbons and that the earth has vast sources of unconventional petroleum reserves in the form of tar sands, bitumen fields and oil shale that will allow for petroleum use to continue in the future, with both the Canadian tar sands and United States shale oil deposits representing potential reserves matching existing liquid petroleum deposits worldwide.

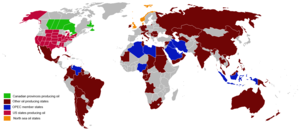

Today, about 90% of vehicular fuel needs are met by oil. Petroleum also makes up 40% of total energy consumption in the United States, but is responsible for only 2% of electricity generation. Petroleum's worth as a portable, dense energy source powering the vast majority of vehicles and as the base of many industrial chemicals makes it one of the world's most important commodities. Access to it was a major factor in several military conflicts, including World War I, World War II and the Persian Gulf War. The top three oil producing countries are Saudi Arabia, Russia, and the United States. About 80% of the world's readily accessible reserves are located in the Middle East, with 62.5% coming from the Arab 5: Saudi Arabia (12.5%), UAE, Iraq, Qatar and Kuwait. However, with today's oil prices, Venezuela has larger reserves than Saudi Arabia due to nonconventional crude reserves derived from bitumen.

Petroleum in Military Strategy

- In World War II the Soviet Union sought to protect their oil fields from falling into the hands of Nazi Germany at the Battle of Stalingrad.

- Many countries have a strategic oil reserve in the event of war or loss of oil supplies.

- During the Iran-Iraq War many nations sent military ships to escort tankers carrying oil.

- During the Gulf War, Iraq's retreating troops burned Kuwait's oil fields in order to give them air cover, to slow the advance of pursuing coalition forces, and to damage the Kuwaiti economy.

- During the Iraq War the United States had military units work to quickly secure oil fields and remove boobytraps. It also had units guarding the Ministry of Petroleum in Baghdad.

Uses

After petroleum has been distilled, the resulting hydrocabons may be used for a variety of purposes:

- Gasoline

- Petroleum jelly

- Plastics

- Fuel oil

- Jet fuel

- Kerosene

Production, consumption and alternatives

The term alternative propulsion or "alternative methods of propulsion" includes both:

- alternative fuels used in standard or modified internal combustion engines (i.e. combustion hydrogen).

- propulsion systems not based on internal combustion, such as those based on electricity (for example, electric or hybrid vehicles), compressed air, or fuel cells (i.e. hydrogen fuel cells).

Nowadays, cars can be classified between the next main groups:

- Pampetro cars, this is, only uses petroleum.

- Hybrid vehicle, that uses petroleum and other source, generally, electricity.

- Petrofree car, that do not use petroleum, like 100 % electric cars, hydrogen vehicles...

See also: renewable energy, greenhouse gas, climate change.

Environmental effects

The presence of oil has significant social and environmental impacts, from accidents and routine activities such as seismic exploration, drilling, and generation of polluting wastes. Oil extraction is costly and sometimes environmentally damaging, although Dr. John Hunt of the Woods Hole Oceanographic Institution pointed out in a 1981 paper that over 70% of the reserves in the world are associated with visible macroseepages, and many oil fields are found due to natural leaks. Offshore exploration and extraction of oil disturbs the surrounding marine environment. Extraction may involve dredging, which stirs up the seabed, killing the sea plants that marine creatures need to survive. Crude oil and refined fuel spills from tanker ship accidents have damaged fragile ecosystems in Alaska, the Galapagos Islands, Spain, and many other places.

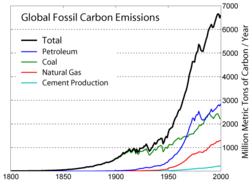

Burning oil releases carbon dioxide into the atmosphere, which contributes to global warming. Per energy unit, oil produces less CO2 than coal, but more than natural gas. However, oil's unique role as a transportation fuel makes reducing its CO2 emissions a particularly thorny problem; amelioration strategies such as carbon sequestering are generally geared for large power plants, not individual vehicles.

Renewable energy alternatives do exist, although the degree to which they can replace petroleum and the possible environmental damage they may cause are uncertain and controversial. Sun, wind, geothermal, and other renewable electricity sources cannot directly replace high energy density liquid petroleum for transportation use; instead automobiles and other equipment must be altered to allow using electricity (in batteries) or hydrogen (via fuel cells or internal combustion) which can be produced from renewable sources. Other options include using biomass-origin liquid fuels (ethanol, biodiesel). Any combination of solutions to replace petroleum as a liquid transportation fuel will be a very large undertaking.

Future of oil

The Hubbert peak theory, also known as peak oil, is a theory concerning the long-term rate of production of conventional oil and other fossil fuels. It assumes that oil reserves are not replenishable (i.e. that abiogenic replenishment, if it exists at all, is negligible), and predicts that future world oil production must inevitably reach a peak and then decline as these reserves are exhausted. Controversy surrounds the theory, as predictions for when the global peak will actually take place are highly dependent on the past production and discovery data used in the calculation.

Proponents of peak oil theory also refer as an example of their theory, that when any given oil well produces oil in similar volumes to the amount of water used to obtain the oil, it tends to produce less oil afterwards, leading to the relatively quick exhaustion and/or commercial unviability of the well in question.

The issue can be considered from the point of view of individual regions or of the world as a whole. Hubbert's prediction for when US oil production would peak turned out to be correct, and after this occurred in 1971 - causing the US to lose its excess production capacity - OPEC was finally able to manipulate oil prices, which led to the oil crisis in 1973. Since then, most other countries have also peaked: Scotland's North Sea, for example in the late 1990s. China has confirmed that two of its largest producing regions are in decline, and Mexico's national oil company, Pemex, has announced that Cantarell Field, one of the world's largest offshore fields, is expected to peak in 2006, and then decline 14% per annum.

For various reasons (perhaps most importantly the lack of transparency in accounting of global oil reserves), it is difficult to predict the oil peak in any given region. Based on available production data, proponents have previously (and incorrectly) predicted the peak for the world to be in years 1989, 1995, or 1995-2000. However these predictions date from before the recession of the early 1980s, and the consequent reduction in global consumption, the effect of which was to delay the date of any peak by several years. A new prediction by Goldman Sachs picks 2007 for oil and some time later for natural gas. Just as the 1971 U.S. peak in oil production was only clearly recognized after the fact, a peak in world production will be difficult to discern until production clearly drops off.

One signal is that 2005 saw a dramatic fall in announced new oil projects coming to production from 2008 onwards. Since it takes on average four to six years for a new project to start producing oil, in order to avoid the peak, these new projects would have to not only make up for the depletion of current fields, but increase total production annually to meet increasing demand. 2005 also saw substantial increases in oil prices due to temporary circumstances, which then failed to be controlled by increasing production. The inability to increase production in the short term, indicating a general lack of spare capacity, and the corresponding uncontrolled price fluctuations, can be interpreted as a sign that peak oil has occurred or is presently in the process of occurring.

According abiogenic theory, hydrocarbons (oil and gas) are abundant resource in the planet earth because petroleum is not a fossil fuel.

Classification

The oil industry classifies "crude" by the location of its origin (e.g., "West Texas Intermediate, WTI" or "Brent") and often by its relative weight ( API gravity) or viscosity (" light", "intermediate" or " heavy"); refiners may also refer to it as " sweet," which means it contains relatively little sulfur, or as " sour," which means it contains substantial amounts of sulfur and requires more refining in order to meet current product specifications. Each crude oil has unique molecular characteristics which are understood by the use of crude oil assay analysis in petroleum laboratories.

The barrels used for reference throughout the world are as follows:

- Brent Crude, comprising 15 oils from fields in the Brent and Ninian systems in the East Shetland Basin of the North Sea. The oil is landed at Sullom Voe terminal in the Shetlands. Oil production from Europe, Africa and Middle Eastern oil flowing West tends to be priced off the price of this oil, which forms a benchmark.

- West Texas Intermediate (WTI) for North American oil.

- Dubai, used as benchmark for Middle East oil flowing to the Asia- Pacific region.

- Tapis (from Malaysia, used as a reference for light Far East oil)

- Minas (from Indonesia, used as a reference for heavy Far East oil)

- Until June 15, 2005, the OPEC basket (a weighted average of oil prices) was comprised of be the average price of the following blends:

In June 15, 2005 the OPEC basket was changed to reflect the characteristics of the oil produced by OPEC members. The new OPEC Reference Basket (ORB) is made up of the following:

OPEC attempts to keep the price of the Opec Basket between upper and lower limits, by increasing and decreasing production. This makes the measure important for market analysts. The OPEC Basket, including a mix of light and heavy crudes, is heavier than both Brent and WTI.

Pricing

References to the oil prices are usually either references to the spot price of either WTI/Light Crude as traded on New York Mercantile Exchange (NYMEX) for delivery in Cushing, Oklahoma; or the price of Brent as traded on the Intercontinental Exchange (ICE, which the International Petroleum Exchange has been incorporated into) for delivery at Sullom Voe. The price of a barrel (which is 42 gallons) of oil is highly dependent on both its grade (which is determined by factors such as its specific gravity or API and its sulphur content) and location. The vast majority of oil will not be traded on an exchange but on an over-the-counter basis, typically with reference to a marker crude oil grade that is typically quoted via pricing agencies such as Argus Media Ltd and Platts. For example in Europe a particular grade of oil, say Fulmar, might be sold at a price of "Brent plus US$0.25/barrel" or as an intra-company transaction. IPE claim that 65% of traded oil is priced off their Brent benchmarks. Other important benchmarks include Dubai, Tapis, and the OPEC basket. The Energy Information Administration (EIA) uses the Imported Refiner Acquisition Cost, the weighted average cost of all oil imported into the US as their "world oil price".

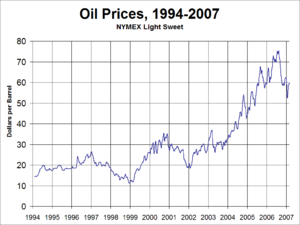

It is often claimed that OPEC sets the oil price and the true cost of a barrel of oil is around $2, which is equivalent to the cost of extraction of a barrel in the Middle East. These estimates of costs ignore the cost of finding and developing oil reserves. Furthermore the important cost as far as price is concerned, is not the price of the cheapest barrel but the cost of producing the marginal barrel. By limiting production OPEC has caused more expensive areas of production such as the North Sea to be developed before the Middle East has been exhausted. OPEC's power is also often overstated. Investing in spare capacity is expensive and the low oil price environment in the late 90s led to cutbacks in investment. This has meant during the oil price rally seen between 2003-2005, OPEC's spare capacity has not been sufficient to stabilise prices.

Oil demand is highly dependent on global macroeconomic conditions, so this is also an important determinant of price. Some economists claim that high oil prices have a large negative impact on the global growth. This means that the relationship between the oil price and global growth is not particularly stable although a high oil price is often thought of as being a late cycle phenomenon.

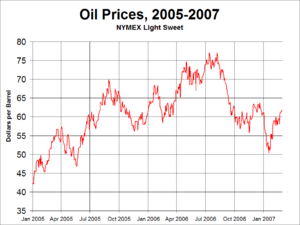

A recent low point was reached in January 1999, after increased oil production from Iraq coincided with the Asian financial crisis, which reduced demand. The prices then rapidly increased, more than doubling by September 2000, then fell until the end of 2001 before steadily increasing, reaching US $40 to US $50 per barrel by September 2004. In October 2004, light crude futures contracts on the NYMEX for November delivery exceeded US $53 per barrel and for December delivery exceeded US $55 per barrel. Crude oil prices surged to a record high above $60 a barrel in June 2005, sustaining a rally built on strong demand for gasoline and diesel and on concerns about refiners' ability to keep up. This trend continued into early August 2005, as NYMEX crude oil futures contracts surged past the $65 mark as consumers kept up the demand for gasoline despite its high price. (see Oil price increases of 2004-2006).)

Individuals can now trade crude oil through online trading sites margin account or their banks through structured products indexed on the Commodities markets.

See also History and Analysis of Crude Oil Prices, asymmetric price transmission, and Crude oil price Benchmarks

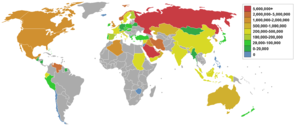

Top petroleum-producing countries

Source: Energy Statistics from the U.S. Government.

For oil reserves by country, see Oil reserves by country.

In order of amount produced in 2004 in MMbbl/d (millions of barrels per day):

| 1. | Saudi Arabia ( OPEC) | 10.37 |

| 2. | Russia | 9.27 |

| 3. | United States 1 | 8.69 |

| 4. | Iran (OPEC) | 4.09 |

| 5. | Mexico 1 | 3.83 |

| 6. | China 1 | 3.62 |

| 7. | Norway 1 | 3.18 |

| 8. | Canada 1,3 | 3.14 |

| 9. | Venezuela (OPEC) 1 | 2.86 |

| 10. | United Arab Emirates (OPEC) | 2.76 |

| 11. | Kuwait (OPEC) | 2.51 |

| 12. | Nigeria (OPEC) | 2.51 |

| 13. | United Kingdom (Scotland) 1 | 2.08 |

| 14. | Iraq (OPEC) 2 | 2.03 |

1 peak production of conventional oil already passed in this state

2 Though still a member, Iraq has not been included in production figures since 1998

3 Canada has the world's second largest oil reserves when tar sands are included, and is the leading source of U.S. imports, averaging 1.7 MMbbl/d in April 2006 .

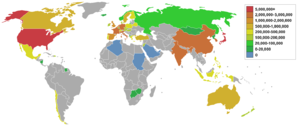

Top petroleum-exporting countries

In order of amount exported in 2003:

- Saudi Arabia (OPEC)

- Russia

- Norway 1

- Iran (OPEC)

- United Arab Emirates (OPEC)

- Venezuela (OPEC) 1

- Kuwait (OPEC)

- Nigeria (OPEC)

- Mexico 1

- Algeria (OPEC)

- Libya (OPEC) 1

1 peak production already passed in this state

Note that the USA consumes almost all of its own production, while the UK has recently become a net-importer rather than net-exporter.

Total world production/consumption (as of 2005) is approximately 84 million barrels per day.

See also: Organization of Petroleum Exporting Countries.