Capitalism

2007 Schools Wikipedia Selection. Related subjects: Politics and government

Capitalism is an economic system in which the competing owners of means of production employ waged labor to produce commodities for sale in a largely free market with a view to making a profit.

Various theories have tried to explain what capitalism is, to justify or critique the private ownership of capital, to explain the operation of markets, and to guide the application or elimination of government regulation of property and markets. (See economics, political economy, laissez-faire.)

| Economies | ||

| Sectors and Systems | ||

| Closed economy | ||

| Dual economy | ||

| Gift economy | ||

| Informal economy | ||

| Market economy | ||

| Mixed economy | ||

| Open economy | ||

| Participatory economy | ||

| Planned economy | ||

| Subsistence economy | ||

| Underground economy | ||

| Real-World Examples and Models | ||

| Anglo-Saxon economy | ||

| American School | ||

| Global economy | ||

| Hunter-gatherer economy | ||

| Information economy | ||

| New industrial economy | ||

| Palace economy | ||

| Plantation economy | ||

| Social market economy | ||

| Transition economy | ||

| Virtual economy | ||

| Ideologies and Theories | ||

| Capitalist economy | ||

| Corporate economy | ||

| Natural economy | ||

| Socialist economy | ||

| Token economy | ||

|

||

Capitalist economic practices became institutionalized in Europe between the 16th and 19th centuries, although some features of capitalist organization existed in the ancient world. Capitalism has emerged as the Western world's dominant economic system since the decline of feudalism, which eroded traditional political and religious restraints on capitalist exchange. Since the Industrial Revolution, capitalism gradually spread from Europe, particularly from Britain, across political and cultural frontiers. In the 19th and 20th centuries, capitalism provided the main, but not exclusive, means of industrialization throughout much of the world.

The concept of capitalism has limited analytic value, given the great variety of historical cases over which it is applied, varying in time, geography, politics and culture. Some economists have specified a variety of different types of capitalism, depending on specifics of concentration of economic power and wealth, and methods of capital accumulation (Scott 2005). During the last century capitalism has been contrasted with centrally planned economies. Most developed countries are usually regarded as capitalist, but some are also often called mixed economies due to government ownership and regulation of production, trade, commerce, taxation, money-supply, and physical infrastructure.

Etymology

According to Webster's Third New International Dictionary, the root word, capital, derives from the Latin word capitalis, which ultimately comes from caput, meaning "head." The 'head' being referred to was that of cattle. The Oxford English Dictionary cited its first use of the word capitalism in 1854, and capitalist in 1792. Marxist writers originally popularized the term "capitalism" (or its equivalents in other languages, such as Kapitalismus) although Marx tended to speak of the "capitalist mode of production" or " bourgeois society." Nevertheless, the term has been widely adopted across the political spectrum, though employed in many different ways (Burnham).

Perspectives on the characteristics of capitalism

The concept of capitalism has evolved over time, with later thinkers often building on the analyses of earlier thinkers. Moreover, the component concepts used in defining capitalism—such as private ownership, markets, and investment—have evolved along with changes in theory, in law, and in practice. The following subsections describe several schools of thought in which the thinkers involved do not necessarily agree on all analytic points, but participate in a common general approach to understanding what capitalism is.

Classical political economy

The "classical" tradition in economic thought emerged in Britain in the late 18th century. The classical political economists Adam Smith, David Ricardo, Jean-Baptiste Say, and John Stuart Mill published analyses of the production, distribution, and exchange of goods in a capitalist economy that have since formed the basis of study for most contemporary economists. Contributions to this tradition are also found in the earlier work of David Hume and the Physiocrats like Richard Cantillon.

Adam Smith's attack on Mercantilism and his reasoning for "the system of natural liberty" in The Wealth of Nations (1776), are usually taken as the beginning of classical political economy. Smith devised a set of concepts that remain strongly associated with capitalism today, particularly his theory of the " invisible hand" of the market, through which the pursuit of individual interest produces a collective good for society. He criticized monopolies, tariffs, duties, and other state enforced restrictions of his time and believed that the market is the most fair and efficient arbitrator of resources. This view was shared by David Ricardo, second most important of the classical political economists and one of the most influential economists of modern times. In The Principles of Political Economy and Taxation (1817) he developed law of comparative advantage, which explains why it is profitable for two parties to trade, even if one of the trading partners is more efficient in every type of economic production. This principle supports the economic case for free trade. Ricardo was a supporter of Say's Law and held view that full employment is the normal equilibrium for a competitive economy. He also argued that inflation is closely related to changes in quantity of money and credit and was a proponent of the law of diminishing returns, which states that each additional unit of input yields less and less additional output.

The values of classical political economy are strongly associated with the classical liberal doctrine of minimal government intervention in the economy. Liberal capitalist thought has generally assumed a clear division between the economy and other realms of social activity, such as the state.

Marxian political economy

Karl Marx considered capitalism to be a historically specific mode of production (the way in which the productive property is owned and controlled, combined with the corresponding social relations between individuals based on their connection with the process of production) in which capital has become the dominant means of production (Burnham). The capitalist stage of development or "bourgeois society," for Marx, represented the most advanced form of social organization to date.

Following Adam Smith, Marx distinguished the use value of commodities from their exchange value in the market. Capital, according to Marx, is created with the purchase of commodities for the purpose of creating new commodities with a higher exchange value higher than the sum of the original purchases. For Marx, the use of labor power had itself become a commodity under capitalism; the exchange value of labor power, as reflected in the wage, is less than the value it produces for the capitalist. This difference in values, he argues, constitutes surplus value, which the capitalists extract and accumulate. In his book Capital, Marx argues that the capitalist mode of production is distinguished by how the owners of capital extract this surplus from workers—all prior societies had extracted surplus labor, but capitalism was new in doing so via the sale-value of produced commodities.

For Marx, this cycle the extraction of the surplus value by the owners of capital or the bourgeoisie becomes the basis of class struggle. However, this argument is intertwined with Marx's labor theory of value asserting that labor is the source of all value, and thus of profit. This theory is contested by most current economists, including some contemporary Marxian economists (Scott 2005). One line of subsequent Marxian thinking sees the centrally-planned economic systems of existing "communist" societies that were still based on exploitation of labor as " state capitalism."

Some 20th century Marxian economists consider capitalism to be a social formation where capitalist class processes dominate, but are not exclusive (Resnick & Wolff). Capitalist class processes, to these thinkers, are simply those in which surplus labour takes the form of surplus value, usable as capital; other tendencies for utilization of labor nonetheless exist simultaneously in existing societies where capitalist processes are predominant.

Weberian political sociology

In some social sciences, the understanding of the defining characteristics of capitalism have been strongly influenced by 19th century German social theorist Max Weber. Weber considered market exchange, rather than production, as the defining feature of capitalism; capitalist enterprises, in contrast to their counterparts in prior modes of economic activity, was their rationalization of production, directed toward maximizing efficiency and productivity. According to Weber, workers in pre-capitalist economic institutions understood work in term of a personal relationship between master and journeyman in a guild, or between lord and peasant in a manor.

In his book The Protestant Ethic and the Spirit of Capitalism (1904-1905), Weber sought to trace how capitalism transformed traditional modes of economic activity. For Weber, the 'spirit' of rational calculation eroded traditional restraints on capitalist exchange, and fostered the development of modern capitalism. This 'spirit' was gradually codified by law; rendering wage-laborers legally 'free' to sell work; encouraging the development of technology aimed at the organization of production on the basis of rational principles; and clarifying the separation of the public and private lives of workers, especially between the home and the workplace. Therefore, unlike Marx, Weber did not see capitalism as primarily the consequence of changes in the means of production. Instead, for Weber the origins of capitalism rested chiefly in the rise of a new entrepreneurial 'spirit' in the political and cultural realm. In the Protestant Ethic, Weber suggested that the origins of this 'spirit' was related to the rise of Protestantism, particularly Calvinism.

Capitalism, for Weber, is the most advanced economic system ever developed over the course of human history. Weber associated capitalism with the advance of the business corporation, public credit, and the further advance of bureaucracy of the modern world. Although Weber defended capitalism against its socialist critics of the period, he saw its rationalizing tendencies as a possible threat to traditional cultural values and institutions, and a possible 'iron cage' constraining human freedom.

The German Historical School and the Austrian School

From the perspective of the German Historical School, capitalism is primarily identified in terms of the organization of production for markets. Although this perspective shares similar theoretical roots with that of Weber, its emphasis on markets and money lends it different focus (Burnham). For followers of the German Historical School, the key shift from traditional modes of economic activity to capitalism involved the shift from medieval restrictions on credit and money to the modern monetary economy combined with an emphasis on the profit motive.

In the late 19th century the German historical school of economics diverged with the emerging Austrian School of economics, led at the time by Carl Menger. Later generations of followers of the Austrian School continued to be influential in Western economic thought through much of the 20th century. The Austrian economist Joseph Schumpeter, a forerunner of the Austrian School of economics, emphasized the " creative destruction" of capitalism—the fact that market economies undergo constant change. At any moment of time, posits Schumpeter, there are rising industries and declining industries. Schumpeter, and many contemporary economists influenced by his work, argue that resources should flow from the declining to the expanding industries for an economy to grow, but they recognized that sometimes resources are slow to withdraw from the declining industries because of various forms of institutional resistance to change.

The Austrian economists Ludwig von Mises and Friedrich Hayek were among the leading defenders of market capitalism against 20th century proponents of socialist planned economies. Mises and Hayek argued that only market capitalism could manage a complex, modern economy. Since a modern economy produces such a large array of distinct goods and services, and consists of such a large array of consumers and enterprises, asserted Mises and Hayek, the information problems facing any other form of economic organization other than market capitalism would exceed its capacity to handle information. Thinkers within Supply-side economics built on the work of the Austrian School, and particular emphasize Say's Law: "supply creates its own demand." Capitalism, to this school, is defined by lack of state restraint on the decisions of producers.

Austrian economics has been a major influence on the ideology of libertarianism, which considers laissez-faire capitalism to be the ideal economic system.

Keynesian economics

In his 1936 The General Theory of Employment, Interest, and Money, the British economist John Maynard Keynes argued that capitalism suffered a basic problem in its ability to recover from periods of slowdowns in investment. Keynes argued that a capitalist economy could remain in an indefinite equilibrium despite high unemployment. Essentially rejecting Say's law, he argued that some people may have a liquidity preference which would see them rather hold money than buy new goods or services, which therefore raised the prospect that the Great Depression would not end without what he termed in the General Theory "a somewhat comprehensive socialization of investment."

Keynesian economics challenged the notion that laissez-faire capitalist economics could operate well on their own, without state intervention used to promote aggregate demand, fighting high unemployment and deflation of the sort seen during the 1930s. He and his followers recommended " pump-priming" the economy to avoid recession: cutting taxes, increasing government borrowing, and spending during an economic down-turn. This was to be accompanied by trying to control wages nationally partly through the use of inflation to cut real wages and to deter people from holding money. The premises of Keynes’s work have, however, since been challenged by neoclassical and supply-side economics and the Austrian School.

Another challenge to Keynesian thinking came from his colleague Piero Sraffa, and subsequently from the Neo-Ricardian school that followed Sraffa. In Sraffa's highly-technical analysis, capitalism is defined by an entire system of social relations among both producers and consumers, but with a primary emphasis on the demands of production. According to Sraffa, the tendency of capital to seek its highest rate of profit causes a dynamic instability in social and economic relations.

Neoclassical economics and the Chicago School

Today, most academic research on capitalism in the English-speaking world draws on neoclassical economic thought. It favors extensive market coordination and relatively neutral patterns of governmental market regulation aimed at maintaining property rights, rather than privileging particular social actors; deregulated labor markets; corporate governance dominated by financial owners of firms; and financial systems depending chiefly on capital market-based financing rather than state financing.

The Chicago School of economics is best known for its free market advocacy and monetarist ideas. According to Milton Friedman and monetarists, market economies are inherently stable if left to themselves and depressions result only from government intervention. Friedman, for example, argued that the Great Depression was result of a contraction of the money supply, controlled by the Federal Reserve, and not by the lack of investment as Keynes had argued. Ben Bernanke, Chairman of the Federal Reserve, later acknowledged that Friedman was right to blame Federal Reserve for the Great Depression.

Neoclassical economists, which today are the majority of economists, consider value to be subjective, varying from person to person and for the same person at different times, and thus reject the labor theory of value. Marginalism is the theory that economic value results from marginal utility and marginal cost (the marginal concepts). These economists see capitalists as earning profits by forgoing current consumption, by taking risks, and by organizing production.

History of capitalism

Private ownership of some means of production has existed at least since the invention of agriculture. However, in feudal society much of this property was considered to be inalienable and so capital markets were not established. Some writers see medieval guilds as forerunners of the modern capitalist concern (especially through using apprentices as a kind of paid laborer); but economic activity was bound by customs and controls which, along with the rule of the aristocracy which would expropriate wealth through arbitrary fines, taxes and enforced loans, meant that profits were difficult to accumulate. By the 18th century, however, these barriers to profit were overcome and capitalism became the dominant economic system of much of the world.

In the period between the late 15th century and the late 18th century the institution of private property was brought into existence in the full, legal meaning of the term. Important contribution to the theory of property is found in the work of John Locke, who argued that the right to private property is one of natural rights. Since the Industrial Revolution much of Europe underwent a thoroughgoing economic transformation associated with the rise of capitalism and levels of wealth and economic output in the Western world have risen dramatically.

Over the course of the past five hundred years, capital has been accumulated by a variety of different methods, in a variety of scales, and associated with a great deal of variation in the concentration of economic power and wealth (Scott 2005). Much of the history of the past five hundred years is concerned with the development of capitalism in its various forms, its defense and its rejection, particularly by socialists.

Mercantilism

The earliest stages of modern capitalism, arising in the period between the 16th and 18th centuries, are commonly described as merchant capitalism and mercantilism (Burnham; EB). This period was associated with geographic discoveries by merchant overseas traders, especially from England and the Low Countries; the European colonization of the Americas; and the rapid growth in overseas trade. The associated rise of a bourgeoisie class eclipsed the prior feudal system.

Mercantilism was a system of trade for profit, although commodities were still largely produced by non-capitalist production methods (Scott 2005). Noting the various pre-capitalist features of mercantilism, Karl Polanyi argued that capitalism did not emerge until the establishment of free trade in Britain in the 1830s.

Under mercantilism, European merchants, backed by state controls, subsidies, and monopolies, made most of their profits from the buying and selling of goods. In the words of Francis Bacon, the purpose of mercantilism was "the opening and well-balancing of trade; the cherishing of manufacturers; the banishing of idleness; the repressing of waste and excess by sumptuary laws; the improvement and husbanding of the soil; the regulation of prices…" Similar practices of economic regimentation had begun earlier in the medieval towns. However, under mercantilism, given the contemporaneous rise of the absolutism, the state superseded the local guilds as the regulator of the economy.

Among the major tenets of mercantilist theory was bullionism, a doctrine stressing the importance of accumulating precious metals. Mercantilists argued that a state should export more goods than it imported so that foreigners would have to pay the difference in precious metals. Mercantilists asserted that only raw materials that could not be extracted at home should be imported; and promoted government subsides, such as the granting of monopolies and protective tariffs, were necessary to encourage home production of manufactured goods.

Proponents of mercantilism emphasized state power and overseas conquest as the principal aim of economic policy. If a state could not supply its own raw materials, according to the mercantilists, it should acquire colonies from which they could be extracted. Colonies constituted not only sources of supply for raw materials but also markets for finished products. Because it was not in the interests of the state to allow competition, held the mercantilists, colonies should be prevented from engaging in manufacturing and trading with foreign powers.

Industrial capitalism and laissez-faire

Mercantilism declined in Great Britain in the mid-18th century, when a new group of economic theorists, led by Adam Smith, challenged fundamental mercantilist doctrines as the belief that the amount of the world’s wealth remained constant and that a state could only increase its wealth at the expense of another state. However, in more undeveloped economies, such as Prussia and Russia, with their much younger manufacturing bases, mercantilism continued to find favour after other states had turned to newer doctrines.

The mid-18th century gave rise to industrial capitalism, made possible by the accumulation of vast amounts of capital under the merchant phase of capitalism and its investment in machinery. Industrial capitalism, which Marx dated from the last third of the 18th century, marked the development of the factory system of manufacturing, characterized by a complex division of labor between and within work process and the routinization of work tasks; and finally established the global domination of the capitalist mode of production (Burnham).

During the resulting Industrial Revolution, the industrialist replaced the merchant as a dominant actor in the capitalist system and affected the decline of the traditional handicraft skills of artisans, guilds, and journeymen. Also during this period, capitalism marked the transformation of relations between the British landowning gentry and peasants, giving rise to the production of cash crops for the market rather than for subsistence on a feudal manor. The surplus generated by the rise of commercial agriculture encouraged increased mechanization of agriculture.

The rise of industrial capitalism was also associated with the decline of mercantilism. Mid- to late-nineteenth-century Britain is widely regarded as the classic case of laissez-faire capitalism (Burnham). Laissez-faire gained favour over mercantilism in Britain in the 1840s with the repeal of the Corn Laws and the Navigation Acts. In line with the teachings of the classical political economists, led by Adam Smith and David Ricardo, Britain embraced liberalism, encouraging competition and the development of a market economy.

Finance capitalism and monopoly capitalism

In the late 19th century, the control and direction of large areas of industry came into the hands of financiers. This period has been defined as " finance capitalism," characterized by the subordination of process of production to the accumulation of money profits in a financial system. Major features of capitalism in this period included the establishment of huge industrial cartels or monopolies; the ownership and management of industry by financiers divorced from the production process; and the development of a complex system of banking, an equity market, and corporate holdings of capital through stock ownership. Increasingly, large industries and land became the subject of profit and loss by financial speculators.

Late 19th and early 20th century capitalism has also been described as an era of " monopoly capitalism," marked by the movement from the laissez-faire phase of capitalism to the concentration of capital into large monopolistic or oligopolistic holdings by banks and financiers, and characterized by the growth of large corporations and a division of labor separating shareholders, owners, and managers (Scott 2005).

By the last quarter of the 19th century, the emergence of large industrial trusts had provoked legislation in the U.S. to reduce the monopolistic tendencies of the period. Gradually, the U.S. federal government played a larger and larger role in passing antitrust laws and regulation of industrial standards for key industries of special public concern. By the end of the 19th century, economic depressions and boom and bust business cycles had become a recurring problem. In particular, the Long Depression of the 1870s and 1880s and the Great Depression of the 1930s affected almost the entire capitalist world, and generated discussion about capitalism’s long-term survival prospects. During 1930s, Marxist commentators often posited the possibility of capitalism’s decline or demise, often in alleged contrast to the ability of the Soviet Union to avoid suffering the effects of the global depression.

Capitalism following the Great Depression

The economic recovery of the world's leading capitalist economies in the period following the end of the Great Depression and the Second World War — a period of unusually rapid growth by historical standards — eased discussion of capitalism's eventual decline or demise (Engerman 2001).

In the period following the global depression of the 1930s, the state played an increasingly prominent role in the capitalistic system throughout much of the world. In 1929, for example, total U.S. government expenditures (federal, state, and local) amounted to less than one-tenth of GNP; from the 1970s they amounted to around one-third (EB). Similar increases were seen in all industrialized capitalist economies, some of which, such as France, have reached even higher ratios of government expenditures to GNP than the United States. These economies have since been widely described as " mixed economies."

During the postwar boom, a broad array of new analytical tools in the social sciences were developed to explain the social and economic trends of the period, including the concepts of post-industrial society and welfare statism (Burnham). The phase of capitalism from the beginning of the postwar period through the 1970s has sometimes been described as “ state capitalism”, especially by Marxian thinkers.

The long postwar boom ended in the 1970s, amid the economic crises experienced following the 1973 oil crisis. The “ stagflation” of the 1970s led many economic commentators politicians to embrace neoliberal policy prescriptions inspired by the laissez-faire capitalism and classical liberalism of the 19th century, particularly under the influence of Friedrich Hayek and Milton Friedman. In particular, monetarism, a theoretical alternative to Keynesianism that is more compatible with laissez-faire, gained increasing support in the capitalist world, especially under the leadership of Ronald Reagan in the U.S. and Margaret Thatcher in the UK in the 1980s.

Globalization

Although overseas trade has been associated with the development of capitalism for over five hundred years, some thinkers argue that a number of trends associated with globalization have acted to increase the mobility of people and capital since the last quarter of the 20th century, combining to circumscribe the room to maneuver of states in choosing non-capitalist models of development. Today, these trends have bolstered the argument that capitalism should now be viewed as a truly world system (Burnham). However, other thinkers argue that globalization, even in its quantitative degree, is no greater now than during earlier periods of capitalist trade.

After the abandonment of the Bretton Woods system and the strict state control of foreign exchange rates, the total value of transactions in foreign exchange was estimated to be at least twenty times greater than that of all foreign movements of goods and services (EB). The internationalization of finance, which some see as beyond the reach of state control, combined with the growing ease with which large corporations have been able to relocate their operations to low-wage states, has posed the question of the 'eclipse' of state sovereignty, arising from the growing 'globalization' of capital.

Economic growth in the last half-century has been relatively strong. Life expectancy has almost doubled in the developing world since the postwar years and is starting to close the gap on the developed world where the improvement has been smaller. Infant mortality has decreased in every developing region of the world. Income inequality for the world as a whole is diminishing. Many other variables such as per capita food supplies, literacy, child labor, and access to clean water have also improved.

Political advocacy

Proponents of capitalism

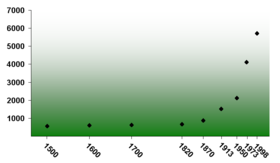

Many theorists and policymakers in predominantly capitalist nations, have emphasized capitalism's ability to promote economic growth, as measured by Gross Domestic Product (GDP), capacity utilization or standard of living. This argument was central, for example, to Adam Smith's advocacy of letting a free market control production and price, and allocate resource. Many theorists have noted that this increase in global GDP over time conincides with the emergence of the modern world capitalist system. While the measurements are not identical, proponents argue that increasing GDP (per capita) is empirically shown to bring about improved standards of living, such as better availability of food, housing, clothing, health care, reduction of working hours, and freedom from work for children and the elderly. Proponents also believe that a capitalist economy offers far more opportunities for individuals to raise their income through new professions or business venture than do other economic forms. To their thinking, this potential is much greater than in either traditional feudal or tribal societies or in socialist societies.

Milton Friedman has argued that the " economic freedom" of competitive capitalism is a requsite of political freedom. Friedman argued that centralized control of economic activity was always accompanied with political repression. In his view, transactions in a market economy are voluntary, and wide diversity that vountary activity permits are fundamental threats to repressive political leaders. Friedman's view was also sheared by Friedrich Hayek and John Maynard Keynes|Keynes] both of whom believed that capitalism is vital for freedom to survive and thrive.

Austrian School economists have aruged that capitalism can organize itself into a complex system without an external guidance or planning mechanism. Friedrich Hayek coined the term " catallaxy" to describe what he consisdered the phenomenon of self-organization underpinning capitalism. From this perspective, in process of self-organization, the profit motive has important role. From transactions between buyers and seller price system emerge, and prices serve as a signal on what are the urgent and unfilled wants of people. The promise of profits gives entrepreneurs incentive to use their knowledge and resources to satisfy those wants. In such way the activities of millions of people, each seeking his own interest, are coordinated.

This decentralized system of coordination is viewed by some supporters of capitalism as one of its greatest strengths. They argue that it permits many solutions to be tried, and that real-world competition generally finds a good solution to emerging challenges. In contrast, they argue, central planning often selects inappropriate solutions as a result of faulty forecasting. However, in all existing modern economies, the state conducts some degree of centralized economic planning (using such tools as allowing the country's central bank to set base interest rates), ostensibly as an attempt to improve efficiency, attenuate cyclical volatility, and further particular social goals. Proponent who follow the Austrian School argue that even this limited control creates inefficiencies because we cannot predict the long-term activity of the economy. Milton Friedman, for example, has argued that the Great depression was caused by the erroneous policy by the Federal reserve.

Critics of capitalism

Capitalism has met with strong opposition throughout its history, largely from the left, but also from the right; and from religious elements. Many 19th century conservatives were among the most strident critics of capitalism, seeing market exchange and commodity production as threats to cultural and religious traditions.

Prominent leftist critics have included socialists and anarchists, such as Karl Marx, Pierre-Joseph Proudhon, Mikhail Bakunin, Franz Fanon, Vladimir Lenin, Leon Trotsky, Peter Kropotkin, Mao Zedong, Noam Chomsky, and others. Movements like the Luddites, Narodniks, Shakers, Utopian Socialists and others have opposed capitalism for various reasons. Marxism has influenced the creation of social democratic and labour parties, which seek change through existing democratic channels instead of revolution. These parties believe that capitalism should be heavily regulated instead of abolished. Many aspects of capitalism have come under attack from the relatively recent anti-globalization movement.

Some religions criticize or outright oppose specific elements of capitalism. Some traditions of Judaism, Christianity, and Islam forbid lending money at interest, although methods of Islamic banking have been developed. Christianity has been the source of many criticisms of capitalism, particularly its materialist aspects. The first socialists drew many of their principles from Christian values (see Christian socialism), against the " bourgeois" values of profiteering, greed, selfishness and hoarding. Many Christians do not oppose capitalism entirely, but support a mixed economy in order to ensure adequate labour standards and relations, as well as economic justice. There are many Protestant denominations (particularly in the United States) who have reconciled with — or are ardently in favour of — capitalism, particularly in opposition to secular socialism.

Some problems claimed to be associated with capitalism include: unfair and inefficient distribution of wealth and power; a tendency toward market monopoly or oligopoly (and government by oligarchy); imperialism, various forms of economic exploitation; and phenomena such as social alienation, inequality, unemployment, and economic instability. Near the start of the 20th century, Vladimir Lenin claimed that state use of military power to defend capitalist interests abroad was an inevitable corollary of monopoly capitalism. Some environmentalists claim that capitalism requires continual economic growth, and will invevitably deplete the finite natural resources of the earth, and other resources utilized broadly. Some environmentalists, such as Murray Bookchin, have argued that capitalist production passes on environmental costs to all of society, and is unable to consider its impact upon ecosystems and the biosphere at large (see externality and social cost).

Democracy, the state and legal frameworks

The relationship between the state, its formal mechanisms, and capitalist societies has been debated in many fields of social and political theory, with active discussion since the 19th century. Hernando de Soto is a contemporary economist who has argued that an important characteristic of capitalism is the functioning state protection of property rights in a formal property system where ownership and transactions are clearly recorded. This is the process which transforms physical assets into capital which may be then be used in many more ways and much more efficiently in the economy. A number of economists have argued that the Enclosure Acts in England, and similar legislation elsewhere, were an integral part of capitalist primitive accumulation and that specific legal frameworks of private land ownership have been integral to the developement of capitalism.

Many theorist of capitalism say that capitalism needs a legal framework for optimal function, and that monopoly, pollution and other perceived market failures can be prevented by regulations, such as different tax and welfare policies. Today, almost all developed nations have such regulations, although the desirable degree is still debated.

The relationship between democracy and capitalism is a contentious area in theory and popular political movements. The extension of universal adult male suffrage in 19th century Britain occurred along with the development of industrial capitalism, and democracy become widespread at the same time as capitalism, leading many theorists to posit a causal relationship between them, or that each affects the other. However, in the 20th century, according to some authors, capitalism also accompanied a variety of political formations quite distinct from liberal democracies, including fascist regimes, monarchies, and single-party states (Burnham). While some thinkers argue that capitalist development more-or-less inevitably eventually leads to the emergence of democracy, others dispute this claim. Research on the democratic peace theory further argue that capitalist democracies rarely make war with one another and have little internal violence.

Some commentators argue that though economic growth under capitalism has led to democratization in the past, it may not do so in the future. Under this line of thinking, authoritarian regimes have been able to manage economic growth without making concessions to greater political freedom.

In response to criticism of the system, some proponents of capitalism have argued that its advantages are supported by empirical research. For example, advocates of different Index of Economic Freedom point to a statistical correlation between nations with more economic freedom (as defined by the Indices) and higher scores on variables such as income and life expectancy, including the poor in these nations. Some peer-reviewed studies find evidence for causation.