Ultimatum game

2007 Schools Wikipedia Selection. Related subjects: Games

The ultimatum game is an experimental economics game in which two parties interact anonymously and only once, so reciprocation is not an issue. The first player proposes how to divide a sum of money with the second party. If the second player rejects this division, neither gets anything. If the second accepts, the first gets her demand and the second gets the rest.

Equilibrium analysis

For illustration, we will suppose there is a smallest division of the good available (say 1 cent). Suppose that the total amount of money available is x.

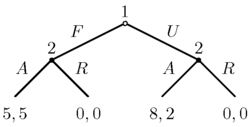

The first player chooses some amount in the interval [0,x]. The second player chooses some function f: [0, x] → {"accept", "reject"} (i.e. the second chooses which divisions to accept and which to reject). We will represent the strategy profile as (p, f), where p is the proposal and f is the function. If f(p) = "accept" the first receives p and the second x-p, otherwise both get zero. (p, f) is a Nash equilibrium of the Ultimatum game if f(p) = "accept" and there is no y > p such that f(y) = "accept" (i.e. p is the largest amount the second will accept). The first player would not want to unilaterally increase her demand since the second will reject any higher demand. The second would not want to reject the demand, since he would then get nothing.

There is one other Nash equilibrium where p = x and f(y) = "reject" for all y>0 (i.e. the second rejects all demands that gives the first any amount at all). Here both players get nothing, but neither could get more by unilaterally changing their strategy.

However, only one of these Nash equilibria satisfies a more restrictive equilibrium concept, subgame perfection. Suppose that the first demands a large amount that gives the second some (small) amount of money. By rejecting the demand, the second is choosing nothing rather than something. So, it would be better for the second to choose to accept any demand that gives him any amount whatsoever. If the first knows this, she will give the second the smallest (non-zero) amount possible.

Experimental results

In many cultures, people offer "fair" (e.g., 50:50) splits, and offers of less than 20% are often rejected. These results (along with similar results in the Dictator Game) are taken to be evidence against the Homo economicus model of individual decisions. Since an individual who rejects a positive offer is choosing to get nothing rather than something, individuals must not be acting solely to maximize their economic gain. Several attempts to explain this behaviour are available. Some authors suggest that individuals are maximizing their expected utility, but money does not translate directly into expected utility. Perhaps individuals get some psychological benefit from engaging in punishment or receive some psychological harm from accepting a low offer.

Based on fMRI studies of the brain during decision-making, different brain regions activate dependent upon whether the participating subject "accepts" or "declines" an offer. Since to "decline" means that neither receives any money, the responder is actually "punishing" the player who makes a low offer. Punishing activates the part of the brain that is associated with the dopamine pathway — i.e. it provides pleasure to punish. Hence, the subjects who refuse and punish in the process, possibly receive more pleasure from punishment than they would from accepting a low offer. This is, therefore, an expected utility argument where the currency is in pleasures received rather than goods or their associated values in money.

Explanations

The classical explanation of the Ultimatum game as a well-formed experiment approximating general behaviour often leads to a conclusion that the Homo economicus model of economic self-interest is incomplete. However, several competing models suggest ways to bring the cultural preferences of the players within the optimized utility function of the players in such a way as to preserve the utility maximizing agent as a feature of microeconomics. For example, researchers have found that Mongolian proposers tend to offer even splits despite knowing that very unequal splits are almost always accepted. Similar results from other small-scale societies players have led some researchers to conclude that " reputation" is seen as more important than any economic reward. Another way of integrating the conclusion with utility maximization is some form of Inequity aversion model (preference for fairness).

An explanation which was originally quite popular was the "learning" model, in which it was hypothesized that proposers’ offers would decay towards the sub game perfect NE (almost zero) as they mastered the strategy of the game. (This decay tends to be seen in other iterated games). However, this explanation ( bounded rationality) is less commonly offered now, in light of empirical evidence against it.

It has been hypothesised (e.g. by James Surowiecki) that very unequal allocations are rejected only because the absolute amount of the offer is low. The concept here is that if the amount to be split were ten million dollars a 90:10 split would probably be accepted rather than spurning a million dollar offer. Essentially, this explanation says that the absolute amount of the endowment is not significant enough to produce strategically optimal behaviour. However, many experiments have been performed where the amount offered was substantial: studies by Cameron and Hoffman et al. have found that the higher the stakes are the closer offers approach an even split, even in a 100 USD game played in Indonesia, where average 1995 per-capita income was 670 USD. Rejections are reportedly independent of the stakes as this level, with 30 USD offers being turned down in Indonesia, as in the United States, even though this equates to two week's wages in Indonesia.

Evolutionary game theory

Other authors have used evolutionary game theory to explain behaviour in the Ultimatum Game. Simple evolutionary models, e.g. the replicator dynamics, cannot account for the evolution of fair proposals or for rejections. These authors have attempted to provide increasingly complex models to explain fair behaviour.

Sociological applications

The split dollar game is important from a sociological perspective, because it illustrates the human willingness to accept injustice and social inequality.

The extent to which people are willing to tolerate different distributions of the reward from " cooperative" ventures results in inequality that is, measurably, exponential across the strata of management within large corporations. See also: Inequity Aversion within companies.

Some see the implications of the Ultimatum game as profoundly relevant to the relationship between society and the free market, with Prof. P.J. Hill, ( Wheaton College (Illinois)) saying:

- “I see the [ultimatum] game as simply providing counter evidence to the general presumption that participation in a market economy (capitalism) makes a person more selfish.”

History

The first Ultimatum game was developed in 1982 as a stylized representation of negotiation, by Güth, Werner, Schmittberger, and Schwarze. It has since become the most popular of the standard Experiments in economics, and is said to be "catching up with the Prisoner's dilemma as a prime show-piece of apparently irrational behaviour."

Variants

In the “Competitive Ultimatum game” there are many proposers and the responder can accept at most one of their offers: With more than three (naïve) proposers the responder is usually offered almost the entire endowment (which would be the Nash Equilibrium assuming no collusion among proposers).

The “Ultimatum Game with tipping” – if a tip is allowed, from responder back to proposer the game includes a feature of the trust game, and splits tend to be (net) more equitable.

The “Reverse Ultimatum game” gives more power to the responder by giving the proposer the right to offer as many divisions of the endowment as they like. Now the game only ends when the responder accepts an offer or abandons the game, and therefore the proposer tends to receive slightly less than half of the initial endowment.